MasterCard, Visa And PayPal On The Rise Even As The Financial Services Industry Declines In MBLM’s Brand Intimacy 2019 Study

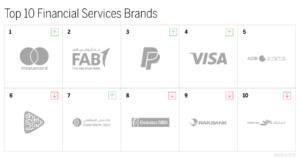

The financial services industry showed an overall decline in building emotional connections with customers, dropping down two places from #4 to #6 among the 15 industries researched by MBLM in the Brand Intimacy 2019 Study. Payments network brands all rose up the rankings—MasterCard to 1st place from 4th, PayPal to 3rd from 10th, and Visa to 4th from 11th. FAB, at #2, is the only bank among the top four brands. The other brands in the top ten for this category are Abu Dhabi Islamic Bank (ADIB), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Emirates NBD, RAKBANK, and Mashreq, in that order.

Brand Intimacy is defined as the emotional science that measures the bonds we form with the brands we use and love. Top intimate brands continue to significantly outperform top brands in the Fortune 500 and S&P indices in both revenue and profit over the past 10 years, according to the Brand Intimacy 2019 Study. MBLM leverages the yearly study to help client brands create, sustain, and measure ultimate brand relationships.

“As consumer behavior evolves and becomes more technology-oriented, consumers’ strongest emotional engagement is with brands that enable a digital lifestyle,” stated William Shintani, managing partner at MBLM. “Consumers are building stronger emotional bonds with the brands that enable them to move money faster, pay more conveniently and require less steps to transact, which are aligned with a more digitally oriented lifestyle.”

Additional noteworthy findings in the financial services industry include:

• PayPal is the #1 financial industry brand users say they cannot live without. 64% of users also reported feeling an immediate emotional connection with this brand.

• MasterCard ranks highest in Brand Intimacy among millennials (18-34 year olds) and men.

• Within the industry, Visa performs best among 35-64 year olds.

• ADIB ranks highest in Brand Intimacy among women surveyed.

• FAB was the Most Intimate Brand in the industry for high-income users.

• Low-income users selected DIB as their Most Intimate Brand.

To view more industry-specific data, please click here.

To download the full Brand Intimacy 2019 Report, please click here or explore the Data Dashboard, please click here.

Methodology: During 2018, MBLM with Praxis Research Partners conducted an online quantitative survey among 6,200 consumers in the U.S. (3,000), Mexico (2,000), and the United Arab Emirates (1,200). Participants were respondents who were screened for age (18 to 64 years of age) and annual household income ($35,000 or more) in the U.S. and socioeconomic levels in Mexico and the UAE (A, B, and C socioeconomic levels). Quotas were established to ensure that the sample mirrored census data for age, gender, income/socioeconomic level, and region. The survey was designed primarily to understand the extent to which consumers have relationships with brands and the strength of those relationships from fairly detached to highly intimate. It is important to note that this research provides more than a mere ranking of brand performance and was specifically designed to provide prescriptive guidance to marketers. We modeled data from over 6,200 interviews and approximately 56,000 brand evaluations to quantify the mechanisms that drive intimacy. Through factor analysis, structural equation modeling, and other sophisticated analytic techniques, the research allows marketers to better understand which levers need to be pulled to build intimacy between their brand and consumers. Thus, marketers will understand not only where their brand falls in the hierarchy of performance but also how to strengthen performance in the future.