Baskin Robbins Climbs Upwards To Rank #1 In The Industry

The fast food industry ranks #13 out of 15 industries studied in the 2019 Brand Intimacy Report, its first move upwards after ranking #14 in both 2018 and 2017. Baskin Robbins leads the industry for the first time in 2019, gaining six spots after ranking #7 in 2018. The remaining positions #2 through #9 in the industry are taken by Costa Coffee, Starbucks, Subway, McDonald’s, KFC, Tim Horton’s, Pizza Hut, Burger King and Shake Shack.

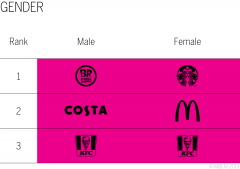

Brands in the industry show a wide variation in performance among different demographics. Millennials display stronger relationships with Costa Coffee, while users between the ages of 35-64 report more intimacy with KFC. Looking at gender and income, Starbucks ranks #1 with female users, while Baskin Robbins takes the top spot with both male and high-income users.

Brand Intimacy is defined as the emotional science that measures the bonds we form with the brands we use and love. Top Intimate Brands outperform top brands in the S&P and Fortune 500 indices for revenue and profit. Consumers are also more willing to pay price premiums for Intimate Brands and less willing to live without them, according to the 2019 Brand Intimacy Report. MBLM leverages the yearly study to help client brands create, sustain and measure ultimate brand relationships.

“Fast food brands have improved their relationships with consumers, despite the growing trends towards healthier food options in the UAE. Consumers report that their emotional bonds with brands are deeply rooted in moments of pampering and gratification,” states William Shintani, managing partner of MBLM. “There continues to be an opportunity for brands in this industry to better leverage emotions when building consumer relationships: to revisit not only their portfolio of offerings, but to also look towards brand-led initiatives strategically targeted to create stronger bonds.”

Other notable findings for the fast food industry include:

- Starbucks ranks highest in the fast food industry for Sharing, the first stage of intimacy, when the person and the brand engage and there is attraction through reciprocity and assurance

- 2% of users in the study report that they can’t live without Baskin Robbins

- 1% of users have an immediate emotional connection with McDonald’s, 33% higher than the industry average

- 3% of users report that they are willing to pay 20% more for Burger King’s products

- Starbucks ranks highest in the industry for daily frequency

- Pizza Hut drops to #8, down five places from being #3 in 2018

To view more industry-specific data, please click here.

To download the full Brand Intimacy 2019 Report please click here, or to explore the Data Dashboard, please click here.

Methodology: During 2018, MBLM with Praxis Research Partners conducted an online quantitative survey among 6,200 consumers in the U.S. (3,000), Mexico (2,000), and the United Arab Emirates (1,200). Participants were respondents who were screened for age (18 to 64 years of age) and annual household income ($35,000 or more) in the U.S. and socioeconomic levels in Mexico and the UAE (A, B, and C socioeconomic levels). Quotas were established to ensure that the sample mirrored census data for age, gender, income/socioeconomic level, and region. The survey was designed primarily to understand the extent to which consumers have relationships with brands and the strength of those relationships from fairly detached to highly intimate. It is important to note that this research provides more than a mere ranking of brand performance and was specifically designed to provide prescriptive guidance to marketers. We modeled data from over 6,200 interviews and approximately 56,000 brand evaluations to quantify the mechanisms that drive intimacy. Through factor analysis, structural equation modeling, and other sophisticated analytic techniques, the research allows marketers to better understand which levers need to be pulled to build intimacy between their brand and consumers. Thus, marketers will understand not only where their brand falls in the hierarchy of performance but also how to strengthen performance in the future.